In today’s fast-moving business environment, compliance is no longer just a legal requirement—it’s a part of everyday operations. One such critical compliance process for Indian businesses is e-Way Bill generation under GST.

As we move into 2026, e-Way Bill automation is no longer a “nice-to-have” feature. It has become essential for small and medium businesses that want to stay compliant, avoid penalties, and save time. Let’s break down what this means, why it matters, and how tools like TallyPrime are shaping this change.

What Is e-Way Bill Automation?

An e-Way Bill is required whenever goods worth more than a specified value are moved from one place to another. Traditionally, businesses generated these bills manually by entering invoice details on the government portal.

e-Way Bill automation means this process happens automatically from your accounting software. Invoice data flows directly into the e-Way Bill system—without repeated manual entry.

In simple words:

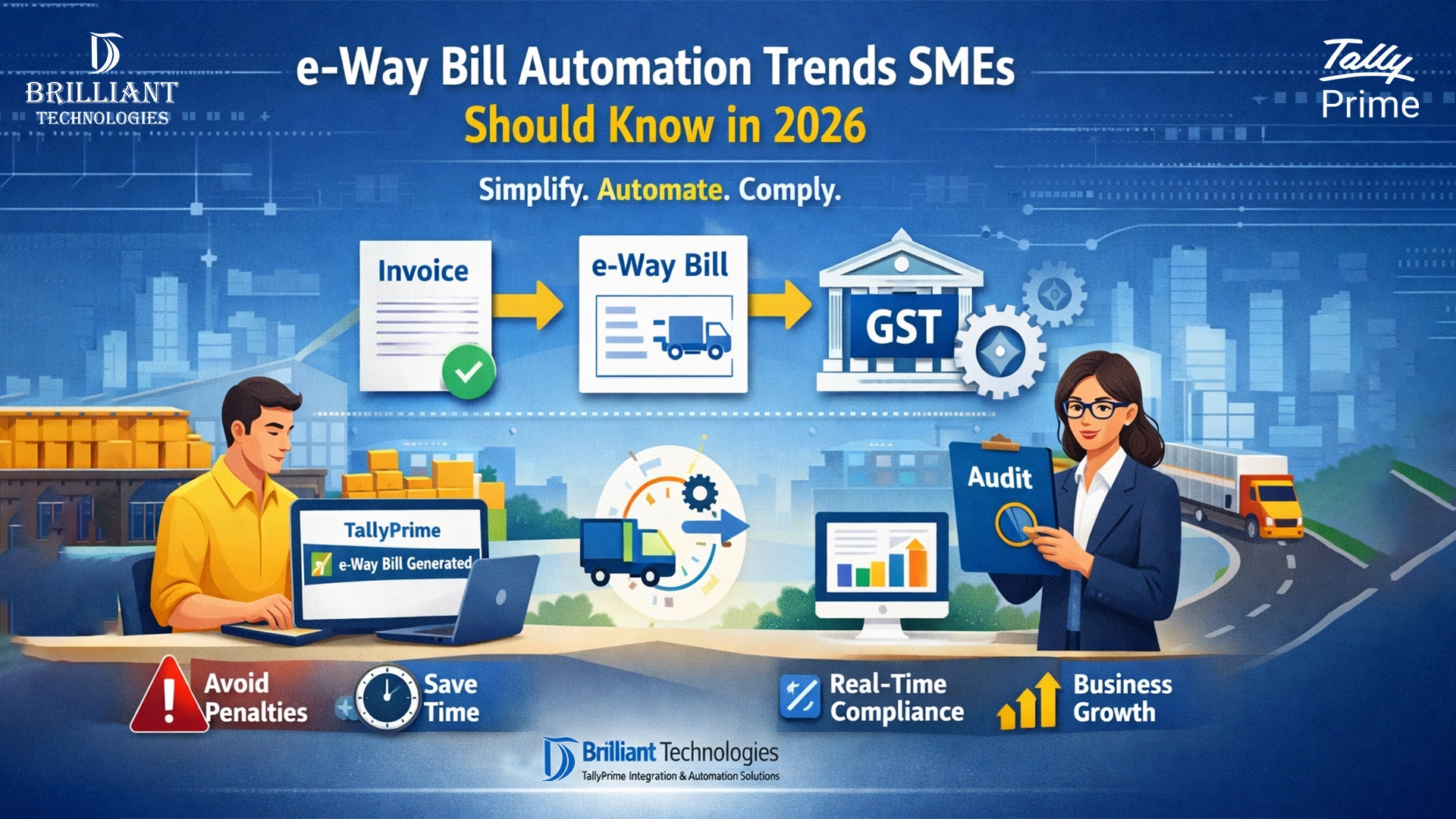

Create an invoice → generate an e-Way Bill instantly → stay compliant.

Why e-Way Bill Automation Is Important in 2026

GST rules are becoming more closely monitored, and data mismatches are easily detected. Manual processes increase the risk of errors, delays, and penalties.

Here’s why automation matters more than ever:

- GST departments now rely heavily on real-time data matching

- Transport delays due to missing or incorrect e-Way Bills are costly

- Businesses are handling higher invoice volumes than before

- Owners want visibility without depending on manual follow-ups

Automation ensures your compliance keeps pace with your business growth.

Common Challenges Faced by SMEs

Many SMEs still struggle with e-Way Bills due to practical, day-to-day issues:

- Re-entering the same invoice data multiple times

- Errors in GSTIN, HSN codes, or transport details

- Last-minute e-Way Bill generation during dispatch

- Dependence on accountants for every small change

- Fear of penalties due to missed or incorrect filings

How TallyPrime Helps Solve These Challenges

TallyPrime is designed for non-technical users while still being powerful enough for accountants.

With built-in e-Way Bill features, businesses can:

- Generate e-Way Bills directly from sales invoices

- Avoid duplicate data entry

- Reduce human errors with automatic validations

- Handle single or bulk e-Way Bills with ease

- Stay aligned with GST portal requirements

For businesses looking for TallyPrime e-way bill automation in Hyderabad, proper setup and guidance make a big difference in daily operations.

Practical Benefits for Small and Medium Businesses

When e-Way Bill automation is implemented correctly, SMEs experience clear, real-world benefits:

- Time savings: Less manual work, faster dispatches

- Accuracy: Fewer mistakes and compliance notices

- Peace of mind: Confidence during audits and inspections

- Scalability: Easy handling of increased transaction volume

- Better control: Owners can track compliance without stress

Businesses using TallyPrime GST e-way bill support Hyderabad often find that automation quickly pays for itself through efficiency alone.

The Role of the Right Tally Partner

While the software is powerful, the real value comes from correct implementation and ongoing support. This is where an experienced partner makes a difference.

At Brilliant Technologies, we work closely with SMEs to ensure Tally is not just installed—but truly works for their business.

Our experience in TallyPrime integration Hyderabad and TallyPrime automation solutions Hyderabad helps businesses:

- Configure e-Way Bill features correctly

- Train staff in simple, practical usage

- Resolve GST and e-Way Bill issues quickly

- Adapt Tally to real business workflows

We focus on clarity, not complexity—so business owners always feel in control.

Final Thoughts

As compliance becomes more data-driven in 2026, e-Way Bill automation is no longer optional for Indian SMEs. Businesses that embrace smart tools and expert guidance are better prepared to stay compliant, reduce risk, and grow with confidence.

Choosing the right Tally partner ensures your systems support your business—not slow it down. With the right setup, training, and support, SMEs can face GST compliance calmly and focus on what truly matters: running and growing their business.